These two credit card issuers both outpaced the market and have seen significant gains so far this year.

Throughout the recent weak market, credit card businesses have been among the most resilient. Last year, all four of the major credit card companies—Visa, Mastercard, American Express (AXP 1.22%), and Discover Financial Services (DFS -0.38%)—outperformed the market.

The last two, however—American Express and Discover—are very different from the two biggest credit card companies, Visa and Mastercard. This is because they use closed-loop models, which means that they act as credit processors, lenders, and issuers simultaneously within their own networks. Both are excellent stocks, but let’s examine them more closely to see which is the superior investment.

Key differences between American Express and Discover

Although Discover and American Express both have closed-loop networks, there is a significant distinction in the ways that they make money. The majority of American Express’s income comes from fees, specifically discount fees. These are the costs that retailers bear when a customer uses an American Express card to make a purchase. Because it can afford to serve a wealthier clientele and corporate clients, American Express can charge far greater merchant, or swipe, fees than other credit card providers. The businesses are often ones that sell more expensive goods, and while they dislike having to pay higher fees, they like the revenue that American Express customers bring in.

Annual fees make up a sizable portion of American Express’s other revenue stream. Because membership offers benefits and rewards, it charges clients greater annual fees.

In the fourth quarter, American Express generated $14.2 billion in revenue, of which $8.2 billion came from merchant fees, $1.6 billion from yearly fees, and $1.2 billion from service fees. Only $3.9 billion, or around 27%, was made from interest. This is so because the model specifies lower and occasionally no interest on balances.

The majority of Discover’s income comes from interest income, which is the complete opposite. Discover behaves more like a bank or lender in that regard. Discover reported $3.7 billion in revenue for the fourth quarter, $3.1 billion of which, or 83%, came from net interest income on loans the company gives cardholders to use for purchases.

Because Discover charges lesser costs than American Express, as well as because Discover provides a cash back rewards feature that compensates the user out of those fees, discount or interchange fees—also known as swipe fees—account for significantly less.

Both businesses are coming off solid fourth quarters; Discover experienced a 20% year-over-year increase in loans and a 27% year-over-year gain in revenue. Revenue for American Express increased by 17% year over year in the most recent quarter, and network spending increased by 12% year in year to $413 billion. Given the challenges of high prices and a declining economy that continue through 2023, the results are excellent.

Which is the better buy?

Both of these firms are well-positioned to grow through 2023 and beyond. Although there are still economic headwinds and the threat of a financial crisis or economic slump looms, both have strategies that will help them get through any choppy waters.

Even if borrowing slows or slightly declines in a downturn, Discover will profit from higher rates of interest on its loans, which should boost interest income. Because of its wealthy members and business customers, the company is less susceptible to a downturn. Additionally, American Express depends largely on travel expenditures, which should rise as the country recovers from the pandemic.

Even if borrowing slows or slightly declines in a downturn, Discover will profit from higher rates of interest on its loans, which should boost interest income. Because of its wealthy members and business customers, the company is less susceptible to a downturn. Additionally, American Express depends largely on travel expenditures, which should rise as the country recovers from the pandemic.

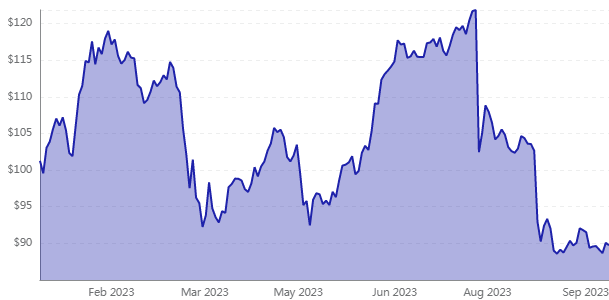

Both of these equities are currently buy recommendations from me. Discover is up roughly 14%, while American Express’s share is up 17% year to far. Currently, Explore is the better investment because it trades at only 7 times profits, compared to over 18 for American Express. Additionally, Discover offers a little greater dividend with a yield of 2.2% and 12 consecutive years of yearly increases.

In the end, I’d probably choose Discover over the other because it’s less expensive, pays a respectable yield, and is designed to withstand recessions until the economy picks up again. However, both are decent investments.

10 stocks we like better than American Express

When our expert team offers a stock suggestion, paying attention can be beneficial. After all, the Motley Fool Stock Guide newsletter, which they have been publishing for more than ten years, has tripled the market.

They recently disclosed their list of the top 10 equities, in their opinion. Among them, American Express wasn’t one. They believe these 10 equities to be even better investments, that’s correct.